tax benefit rule examples

This rule in theory. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit.

What Are Marriage Penalties And Bonuses Tax Policy Center

A tax benefit in the prior taxable year from that itemized deduction.

. That is they help determine what activities the. Example of the Tax Benefit Rule. Legal Definition of tax benefit rule.

In December 2017 as part of the Tax Cuts and Jobs Act PL. The commuting use of an employer-provided automobile. The rule is promulgated by the Internal Revenue Service.

The way to look at the rule is what would your tax return have looked like if you had NOT claimed the deduction. 99514 1812a2 substituted reducing tax imposed by this chapter for reducing income subject to tax or reducing tax imposed by this chapter as the case may be. In 2019 A received a 1500 refund of state income taxes paid in 2018.

Itemized deductions make sense if the sum of your qualified expenses is greater than your standard deduction. Under the benefit principle taxes are seen as serving a function similar to that of prices in private transactions. For example if a single taxpayers itemized expenses total.

Jones recovers a 1000 loss that he had written off in his previous years tax return. Examples of tax benefit. A tax benefit also includes.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. For example when a taxpayer failed to include funds embezzled. What is the Tax Benefit Rule.

The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event. Its also the name of an IRS rule requiring companies to pay taxes on income. However in 2012 the taxpayer receives a state tax refund.

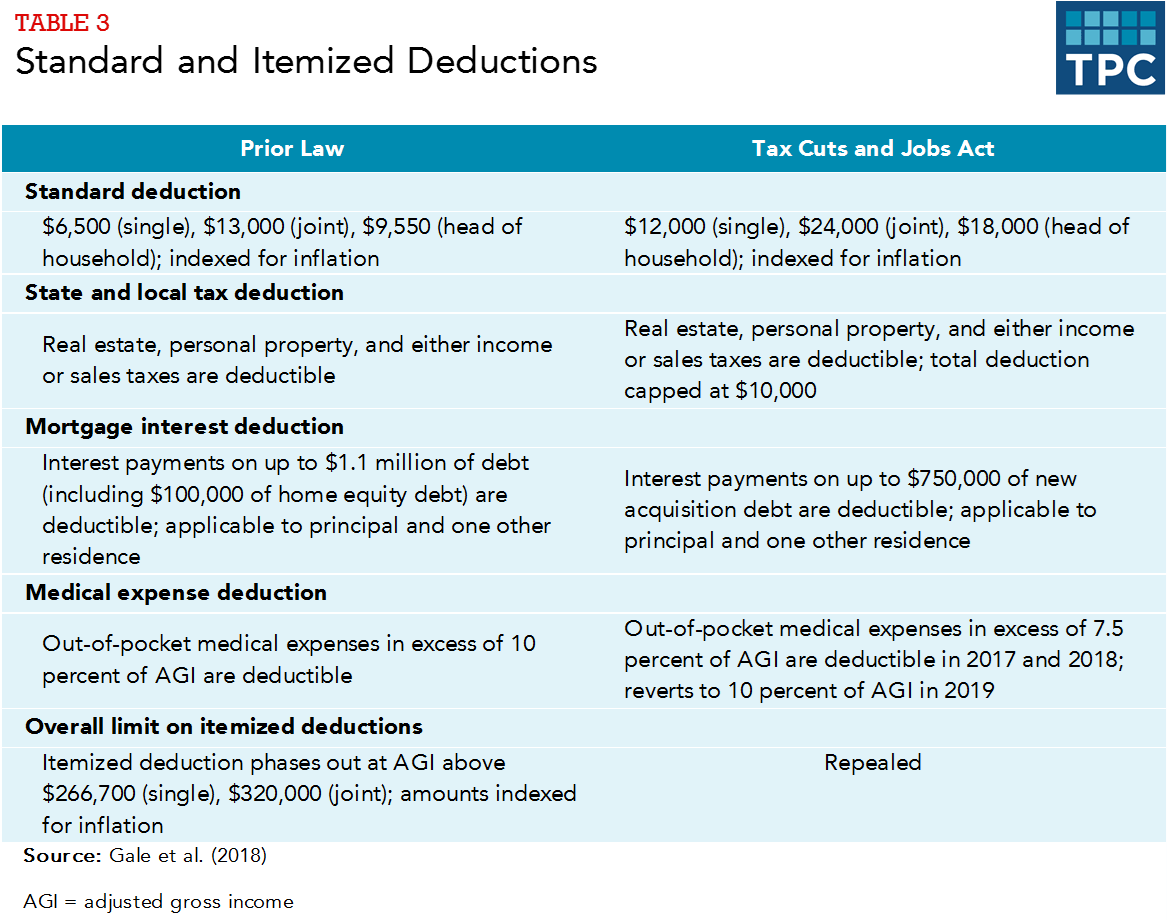

If the couple received a state tax refund of 500 in the current year the. For example a state tax refund you must report as income the amount of tax benefit you had received from. 115-97 TCJA Congress enacted new Internal Revenue Code Section 164 b 6 limiting individuals state and.

The 1000 must be included in his current years reported gross income. For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included in the current years gross income. A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden.

State income tax refund fully includable. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. Other example is a claim against the taxpayer such as a local property tax or an employees salary which is deducted when paid.

Consider a taxpayer who pays 10000 of state. Merged into the subsidiaryI Recovery of previously omitted income also invokes the tax benefit rule. A somewhat more complicated and more common example involves payments of state income taxes in both year 1 and year 2.

If you didnt derive a benefit from claiming the deduction the refund isnt taxable. Tax Benefit Rule 55 TAXES 321 1977. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

Small Business Tax Guide. You receive an Iowa tax refund of 1000 when you filed your 2016 tax return in 2017. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation.

Some examples of benefits that arent excludable as de minimis fringe benefits are season tickets to sporting or theatrical events. So for example if Jane bought a 500 ticket to a nonprofit fundraising gala and received a dinner worth 100 she could only claim 400 as a tax deduction. Learn it well before April 15 arrives.

A tax benefit is interpreted broadly and includes any exclusion deduction or credit which reduced federal income tax due in a prior year.

/claiming-adult-dependent-tax-rules-4129176_updated-f6071c45f647429d8fa9a9dc58c0cd74.gif)

Tax Rules For Claiming Adult Dependents

What Is A Homestead Exemption And How Does It Work Lendingtree

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Turning Losses Into Tax Advantages

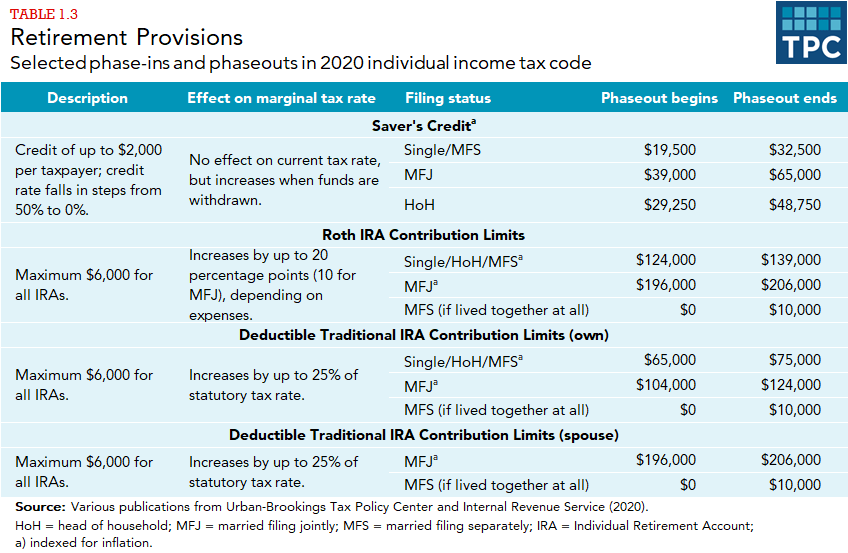

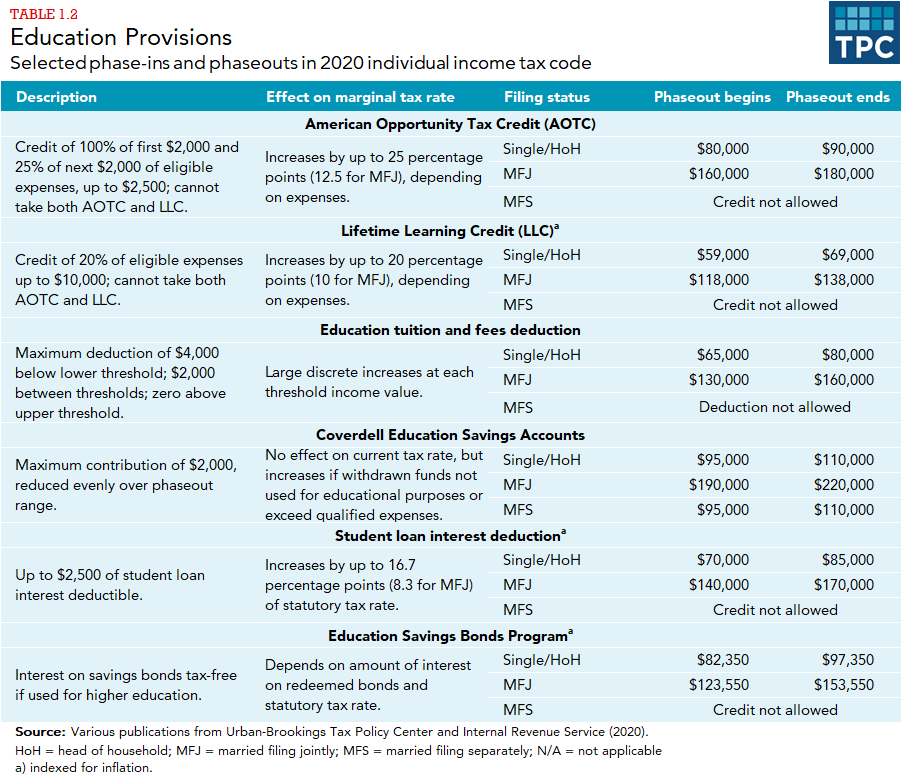

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Annuity Taxation How Various Annuities Are Taxed

Tax Advantages For Donor Advised Funds Nptrust

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How The Tcja Tax Law Affects Your Personal Finances

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

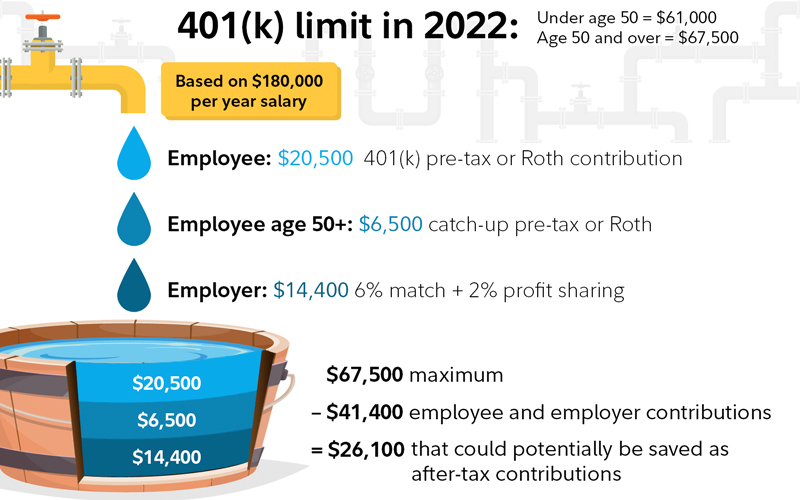

After Tax 401 K Contributions Retirement Benefits Fidelity

Turning Losses Into Tax Advantages

How Does The Deduction For State And Local Taxes Work Tax Policy Center