what is the property tax rate in ventura county

Similarly what is the. However your tax bill might also include special assessments voted into effect by the voters or by their representatives within the propertys taxing jurisdiction.

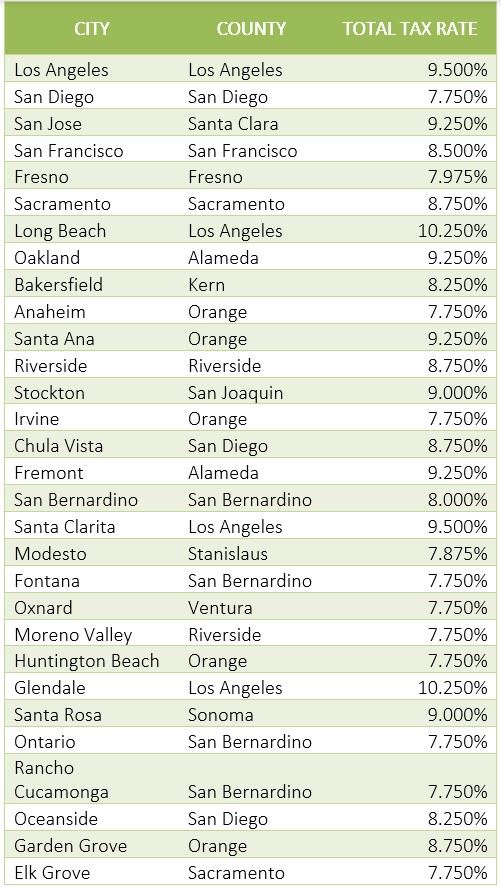

California Sales Tax Guide For Businesses

Revenue Taxation Codes.

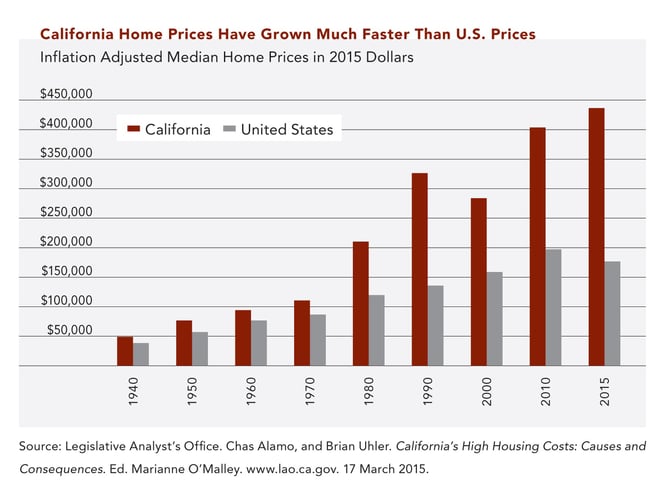

. When buying a house ownership is transferred from the former owner to the buyer. Ventura County has one of the higher property tax rates in the state at around 1095. Customarily whole-year real estate taxes are paid upfront at the beginning of the tax year.

At the same time tax liability switches with the ownership transfer. Ad Search Ventura County Records Online - Results In Minutes. Throughout California the property tax rate is 1 of the assessed value also applies to real property.

The Ventura County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Ventura County and may establish the amount of tax due on that property based on the fair market value appraisal. This is the total of state and county sales tax rates. In no event shall TTC be held liable on any theory of liability for damages or injury of any type resulting from use of TTC web site information.

The median property tax on a 56870000 house is 420838 in California. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The median property tax on a 56870000 house is 335533 in Ventura County.

Note that 1095 is an effective tax rate estimate. The tax cannot exceed 1 of a propertys assessed value plus bonds and direct assessment taxes. Ventura County Homes By Ainslee is a licensed realtor CA BRE.

By Mail - Mailing address is - Homeowners Exemption Section The Ventura County Assessors Office 800 South Victoria Avenue Ventura CA 93009-1270. Besides counties and districts like hospitals many special districts such as water and sewer treatment plants as well as parks and recreation facilities operate with tax money. Property tax in ventura county.

Thousand Oaks includes Newbury Park and Ventura area of Westlake Village. In Person - Visit the Assessors Office at the County Government Center - Hall of Administration. Ventura County Assessors Office Services.

26 counties have higher tax rates. The property tax rate is 1 of the assessed value. 4 rows SEE Detailed property tax report for 5796 Freebird Ln Ventura County CA Tax description.

Tax Rates and Info - Ventura County. Beside above how do you figure out tax percentage. TREASURER-TAX COLLECTOR VENTURA COUNTY How to Pay Your Property Tax Online Via Credit Card A Step-by-Step Guide STEVEN HINTZ TREASURER TAX COLLECTOR.

With that who pays property taxes at closing while buying a house in Ventura County. The median property tax on a 56870000 house is 597135 in the United States. The ventura county sales tax rate is 025.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar. Tax Rate Database - Ventura County. Blank pursuant to ca gc625421.

Beside this what is the property tax rate in Ventura County. Property Tax in Ventura County. The Ventura County Treasurer-Tax Collectors Office TTC assumes no responsibility for anyones improper or incorrect use of Webtax site information.

Ventura county is ranked 342nd of the 3143 counties for property taxes as a percentage of median income. The most straightforward way to calculate effective tax rate is to divide the income tax expenses by the earnings or income earned before taxes. 30 out of 58 counties have lower property tax rates.

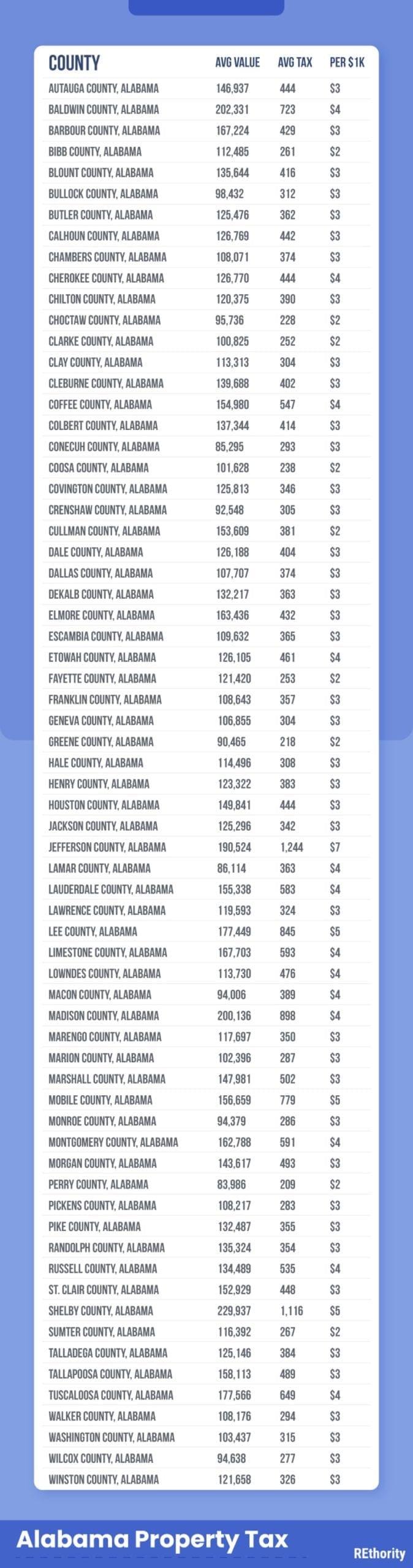

Property taxes are the main source of revenue for Ventura and other local public districts. Property Tax Rate. The median property tax in Ventura County California is 3372 per year for a home worth.

The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of 059 of property value. Find Ventura County Property Tax Info From 2021. Her love for the communities she lives and work in is why she does what she does.

The property tax rate in the county is 078. For example if a company earned 100000 and paid 25000 in taxes the effective tax. 01969612 in the state of California and is a leading authority on Ventura County California area real estate.

O C S Property Tax Hike To Be Small This Year Register On Real Estate Blog Orange County Register House Prices Housing Market Mortgage

New Homes For Sale In Rosamond California Tour Our Well Crafted Homes In Rosamond Broker S Welcome Open House Invitation Open House New Homes For Sale

Property Tax By County Property Tax Calculator Rethority

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Ventura County Assessor Supplemental Assessments

Cash Buyers Playing Big Part In Real Estate Market Open House Open House Real Estate Real Estate Marketing

Ventura And Los Angeles County Property And Sales Tax Rates

The Property Tax Inheritance Exclusion

Home Ownership Lennar New Homes For Sale

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Ventura And Los Angeles County Property And Sales Tax Rates

Real Estate Refresher Helpful Tax Provisions In California And Beyond

Ventura California Ventura California Natural Energy Solar Power Ventura California Ventura Solar Energy Solutions

Ventura County Ca Property Tax Search And Records Propertyshark

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Ventura County Ca Property Tax Search And Records Propertyshark

States With The Highest And Lowest Property Taxes Property Tax States High Low